Republican Senators Sold Stock After Closed-Door Coronavirus Meetings in Apparent Insider Trading

By BEN MATHIS-LILLEY

MARCH 20, 202012:23 AM

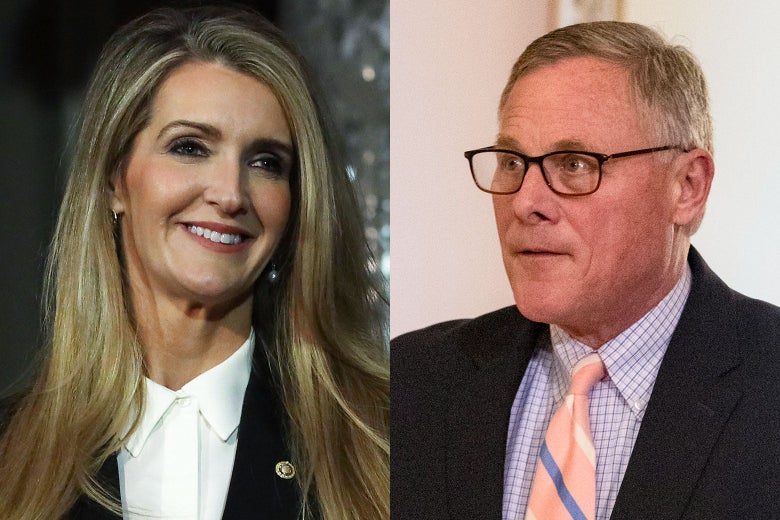

Loeffler and Burr are seen in side by side head shots.'

Georgia Sen. Kelly Loeffler and Republican Sen. Richard Burr.

Samuel Corum/Getty Images

Republican North Carolina Sen. Richard Burr and Republican Georgia Sen. Kelly Loeffler sold a combined $2 to $4 million in stock after attending private briefings about the coronavirus pandemic, even as they publicly amplified the Trump administration line that the virus did not pose a major threat to public health or the economy, disclosures analyzed by ProPublica and the Daily Beast show. The sales were completed before the disruption caused by widespread illness began to trigger major losses in securities markets this month.

Senators from both parties were briefed about the coronavirus by Centers for Disease Control director Robert Redfield and National Institute of Allergies and Infectious Diseases director Anthony Fauci onJan. 24. That private briefing was arranged by the Senate Health Committee, of which Burr is a member. Burr is also the chairman of the Senate Intelligence Committee; a late-February Reuters story reported that the committee had been receiving “daily” updates from intelligence agencies “monitoring the spread of the illness around the world and assessing the responses of governments.” On Feb. 25, Democratic New Hampshire Sen. Jeanne Shaheen complained to Secretary of Health and Human Services Alex Azar at a open Appropriations Committee hearing that a coronavirus briefing Azar had given senators earlier that day had been private; Azar responded that “Chairman Burr, the chairman of the Senate Intelligence Committee, asked that that briefing be held at the top secret level.”

According to his disclosures, Burr made sales of stocks worth between $628,000 and $1.72 million on Feb. 13. This included a sale unloading substantial shares of Wyndham Hotels and Resorts and Extended Stay America, two lodging chains whose stock prices would later plunge as the pandemic shut down travel and tourism. On Feb. 27, according to a report by NPR that was also published Thursday, Burr told a private gathering of wealthy constituents that the virus could be as contagious as the 1918 Spanish flu and that it could create major disruptions to daily life—including, he said specifically, cancellations of business travel.

His message to the general public after the Jan. 24 briefing was rather different. On Feb. 7, Burr co-wrote a Fox News op-ed which asserted that “the United States today is better prepared than ever before to face emerging public health threats, like the coronavirus, in large part due to the work of the Senate Health Committee, Congress, and the Trump Administration.” He does not appear to have issued the warnings he gave in the private Feb. 27 meeting in any public forum.

Loeffler also attended the Jan. 24 briefing; between then and Feb. 14 she made sales worth between $1.275 million and $3.1 million—but made purchases of two stocks, the database-management company Oracle and a company called Citrix which makes teleconferencing software. (The transactions dealt with stock owned jointly by Loeffler and her husband, who is Jeffrey Sprecher, the chairman of the New York Stock Exchange.) On Feb. 28, Loeffler tweeted that Democrats “have dangerously and intentionally misled the American people on #Coronavirus readiness” and that the Trump administration was “doing a great job working to keep Americans healthy & safe.” On March 10, she tweeted that “the economy is strong.”

Neither senator appears to have yet commented on the transactions. Members of Congress are prohibited by law from trading on “material, nonpublic information” derived from their positions.

SLATE.com LINK

Reply With Quote

Reply With Quote